M&A AND SPORTS TECH

The Growth of Mergers and Acquisitions in 2021

2021 the year of deals and consolidation in the world of Sports & Entertainment.

Luis Vicente is one of the world’s leading minds in sports digital. In Amsterdam in 2018, he gave an inspiring presentation that I still vividly remember. Luis reminded the 50+ sports tech startups in the room to “Be Patient and Slow Down” and the “Day of M&A and Consolidation” was coming soon. He challenged everyone to reflect on “what was the real problem they wanted to solve” and how could you, in a perfect world, solve the problem across the Sports and Entertainment landscape if you used M&A, collaboration and deals. I reflect back to this presentation often.

The pandemic of 2020 is clearly the mainstream emergence of Sports Technology (past article on the topic). Furthermore, I anticipate 2021-2022 will be remembered as the years for widespread M&A consolidation within sports supplier and sports technology companies. I formerly worked in M&A, Private Equity and Investment Banking, there are many eerie similarities to back in the GFC in 2008-2010 that I thought are worth sharing and hopefully a few insights that you might find helpful.

Sports Tech Has Been Like a Steam train, without Any Brakes!

The Sports Tech industry is wonderful because it’s built on speed, engagement and adaptation. Unlike healthtech, fintech and agritech, the world of sports tech has until now seemingly had “no brakes” or regulation to decelerate the locomotion of growth and valuations since it’s emergence over a decade ago. The equation was simple: Find a way to use data, digital and technology to help the world of sports and entertainment to drive more participation, more revenue, more TV viewers, more fans attending, reduce injuries, make stadiums more safe, etc. It’s taken a “once-in-a-hundred year” pandemic to slow it down and reset-the ecosystem. Privacy, data ownership, IP protection, outsourcing, share services and digital ethics will all be part of learning improvements and greater governance for the next frontier of Sports Tech. And I’m naturally very excited for the future of Sports Tech. But the opportunity for continued market growth comes at a price. Market maturity and industry consolidation is desperately needed. My belief is that 2021 will be the year and here’s a few reasons why:

Four Current Problems

1. Too fragmented – From Video Editing, ConcussionTech, Tracking, Fan Engagement, Graphics, Management Tools, Social Media Tools, Fantasy, Virtual Reality and even Artificial Intelligence/ML, there’s currently a genuine oversupply of 20-150 companies trying to solve the exact same problem across the 24 different categories across Sports Technology. StatsPerform merger was the start. Within the tech world, I argued for two years that Cloudera and Hortonworks should merge as they solved the exact same problem, eventually they did. TV Sports Networks are under fire from OTT and live sports disruptions. Sensible M&A just makes sense and always involves commercial concessions and sacrifices in the aftermath of an economic crisis. Mature markets only have room for the Top 2 or Top 4 (oligopoly, duopoly, etc) in each niche market segment worldwide. Fragmentation creates opportunities for “roll-ups” and industry aggregations, like what Stack Sports has successfully achieved with 26+ acquisitions in young and grassroots sports. Smaller companies are often under-capitalised (e.g. lack cash), lack skills, lack vision or execution capabilities to compete for market share. A recent article from Adir Shiffman gives some guidance to surviving the crisis. Here’s another good article on Takeover defence strategies. Bottom Line: I expect an acceleration of Sports Tech M&A and many small-to-medium sized players to be absorbed by incumbents in the coming 18-24 months across the entire Sports Tech landscape. Exits will be frequent and allow incumbents to diversify and scale their offering (e.g. athlete performance system trying to solve problem 1 can now additionally solve problem 2 with the newly acquired technology or service). I expect a few Private Equity firms to finally emerge soon with “Buy-and-Build” strategies that might be both vertically and horizontally integrated within the fragmented Sports Tech market (pre-and-post merger integration is always a big issue, but that can be a topic for another day). Fragmented markets need real rationalisation.

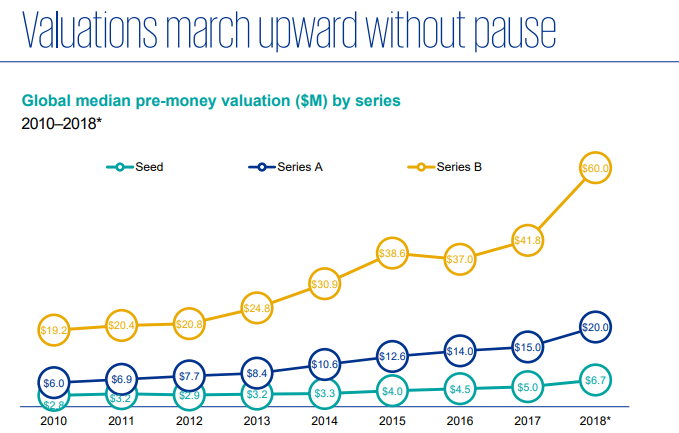

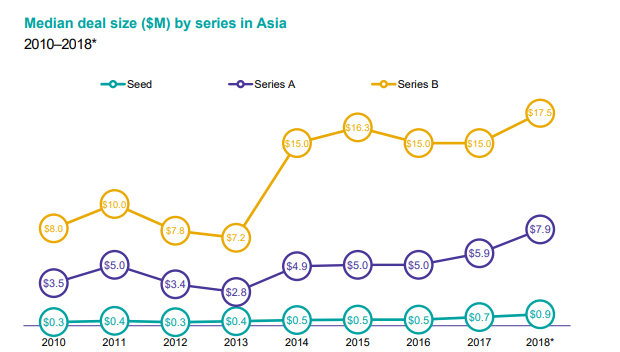

2. Valuations arbitrage = USA v Asia v Europe – It’s well known that valuations of companies in the American sports tech landscape command higher than valuations of counterparts in Asia-Pacific and Europe. Globally, according to KPMG Global Venture Capital report, the average seed stage startup will have a pre-money valuation of $6.7 million USD and $20 million for Series A investment. Asia sports startups attract a significant discount and smaller funding rounds. KPMG suggests the average seed investment is $900k USD and $6.7 million USD for Series A investment. European sport stech companies lie in the middle. Separate recent research from CB Insights re-affirms these valuation ranges differentials.

There’s an inherent valuation arbitrage. Put simply, the current economic climate might be the best opportunity that American Sports Tech companies ever get to assert a global market dominance overnight by M&A. They will need to move quickly as Europe incumbents will also eye this opportunity. Although America is easily the largest sports market in the world (for the next decade will likely remain so), Asia is home to 67% of the world’s population and undoubtedly the growth corridor for the sports and entertainment market maturity for the next 30 years. Meanwhile, America is home to over 80% of the world’s investment and venture capital dedicated to sports and entertainment. There are 2000+ languages spoken across Asia and it’s patchwork of cultural and political nuances often makes Asia difficult to navigate for Americans. Bottom Line: I expect to see a strong rise in American and/or European companies acquiring European/Asian sports tech companies with this valuation arbitrage as long as the valuation arbitrage remains in short-to-medium term. It’s a natural part of market maturity and having larger incumbents. Bargains will be available, and in many cases, the acquisitions if done properly by Top 4 players (within each sub-sector) could be the transformation required to build truly global platforms that will ultimately benefit sports clients with better choice, better talent and more results.

3. Less Cash & More Cash – The new normal of sports will be different. Sports organizations will be smarter, wiser, more frugal and make meaningful digital and technology investments. Paradoxically, if operating budgets are lower (but technology investment is higher!), there is not enough pie potentially for fragmented markets in sports technology. The smarter bet is industry consolidation and giving the client (team, league, NSO, broadcaster, stadium) a more compelling value proposition. Additionally, the new reality is cash-flow is king, and there will be a substantial flight to quality towards cash-generative business models that can be executed simply and globally scale. Going forward, I anticipate there will be little appetite for complexity. Simplicity is here to stay.

4. World Needs Open Collaboration, Not Competition – If M&A isn’t the answer, then the better option might be open collaboration for many firms. One of the lessons I learnt from the 2008-2010 GFC financial crisis was how frequently the most unlikely of rivals became collaborators. My belief is that the fruits of collaboration will be shared between “On Field” and “Business of Sports”, whilst 80% of the biggest companies in Sports Tech work in the Business of Sports (by revenue and employee numbers), the real question is can we explore how to achieve new revenue synergies and cost synergies with different models of collaborations. Maybe I’m odd, but I’ve always been surprised why there aren’t more diversified Sports Tech companies. It seems obvious and builds robustness and resilience.

My final thoughts: If you are a large and fast-growth incumbent, be aggressive and go for the win whilst opportunities remain available. If you’re an SME or startup, be open minded and realistic on your valuation during M&A, takeovers and private equity. My advice is simple, do what is best for yourself, your team, shareholders and awesome clients. The acceleration of M&A is inevitable in 2021-2022 and will be ultimately beneficial to the Sports Technology global market. As Simon Sinek famously reminds us, “Focus on the Why” and ask yourself what was the small impact you came to create in the world of Sports and Entertainment. Be with people that know your value, not your price.

Carpe diem.

__

John Persico is a Director of the Sports Tech World Series, the world’s largest community for Sports Technology professionals.