Top 10 Predictions for Sports Tech in 2021

Following a year like no other, how is the intersection of sports and technology poised to bounce back in 2021?

1. Data-Driven Personalization

Data powered personalization touches every level of the fan and consumer experience across all verticals within sports technology, from business to performance. The ability to combine rich first-party data with AI platforms to produce meaningful, timely and insightful recommendations is a game-changer for sports and connected fitness.

Although AI driven personalization has long been at the core business of big-tech and social media behemoth FAANGs (Facebook, Apple, Amazon, Netflix, Google), sports is only beginning to realise the power and value it can bring to their bottom line. It enables teams, leagues, broadcasters and brands to know more about their customers to drive deeper engagement and higher revenues.

One of the most noticeable applications is to the evolution of the fan viewing experience. OTT and digital platforms can learn a fan’s preferences and behaviours as to when, how and what content they consume. Furthermore, it can create new revenue channels across the viewing experience. Examples of this include in-game odds and advanced statistics for sports betting; integrated e-commerce offering prompting fans to purchase merchandise in response to action on the field; co-viewing or watch together social experiences.

2. Sports Betting

The value of legal US sports bets made in a single month eclipsed the $3 billion mark for the first time in October 2020 (up from $2.87 billion in September 2020). And the world’s largest sports betting market continues to show no signs of slowing. There’s plenty of State Legislatures, sports leagues, teams and broadcasters looking to plug massive revenue holes caused by the 2020 pandemic. Legalized sports betting provides an easy solution for these budget woes so expect to see sports betting (and the underlying tech platforms enabling it) continue strong growth into 2021. Looking further afield from the US, emerging betting markets, such as India, provide opportunities for further growth. Although sports betting itself is illegal in India (for now) the Indian fantasy sports industry is booming, on track to be worth $3.7B by 2024.

3. Big Money Moves & Industry Consolidation

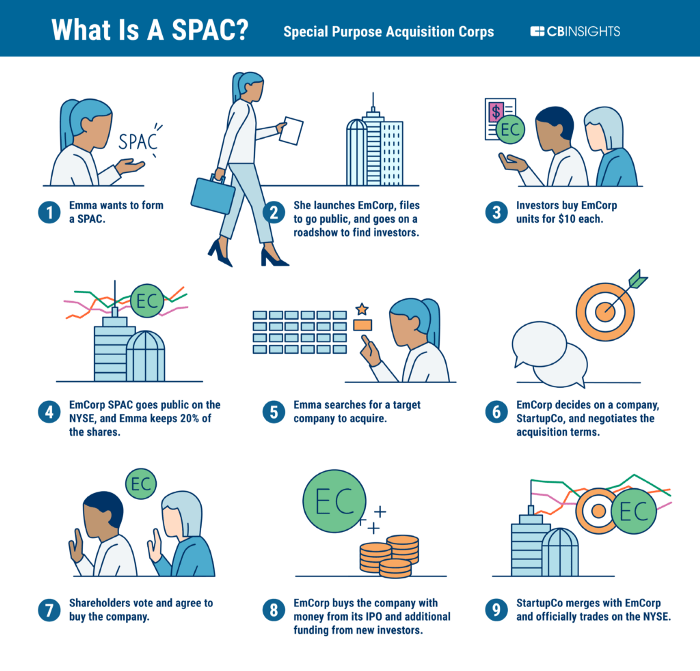

2020 saw the rise of SPACs (Special Purpose Acquisition Company) as a popular investment vehicle in sports, media and technology. One of the most notable is the $575 million RedBall Acquisition Corp led by Gerry Cardinale, founder of private investment firm RedBird Capital Partners LLC, and Billy Beane of the Oakland Athletics (and Money Ball fame). What makes this trend so interesting for 2021 is the timeline of the investment terms for these funds. Typically the SPAC has 12–18 months to spend the funds raised before it needs to be returned to investors. That means the slew of SPACs announced in 2020 (as of early November 2020, there were 33 sports-related SPACs) have until mid-late 2021 to make their acquisitions. Meanwhile, further SPACs continue to be announced, especially those with a particular focus on technology investment opportunities.

A special purpose acquisition company (SPAC) is a “blank check” shell corporation designed to take companies public without going through the traditional IPO process. Source: CB Insights.

Apart from the larger SPAC investments, there are several well-funded sports tech companies looking for growth investment opportunities. These winners of 2020 are looking to consolidate their market position with acquisitions of competitors or roll-ups of several smaller companies that may not have fared as well during the pandemic and associated economic downturn.

4. 5G Powered Remote Production

The pandemic forced broadcasters to realise the potential of what’s possible with an almost fully remote and largely automated production stack. This isn’t necessarily new technology — for a great intro to the remote production stack see Ben Reynolds’ presentation from 2019 — but the widespread rollout of 5G into 2021 is a boost for the adoption of remote production.

Almost 92% of broadcasters are planning to adopt 5G in the next two years, and remote production has been identified as a major application of 5G wireless technology. 5G has the great potential to enable broadcasters to enhance coverage by allowing multiple cameras and microphones, whilst streamlining production by managing multiple live events from a central broadcast facility.

5. Mixed Reality Broadcast Experience

The application of Augmented Reality (AR) and Virtual Reality (VR) to the live sports viewing experience will become more commonplace. As we recently saw with Nickelodeon’s “slime” filled NFL Wildcard Game, AR integrations are a playground for the next iteration of the broadcast experience. Mixed reality is another area supported and accelerated by the widespread application of 5G technology.

6. Optical Tracking Systems — Greater Accuracy & Smartphone Enabled

Optical tracking systems are unlikely to completely replace wearable tech, but the unobtrusive and automated nature of video tracking has obvious benefits for capturing performance data over applying devices to the athlete. Furthermore, the recent advances in the use of smartphone cameras, instead of traditionally expensive and cumbersome fixed camera systems, is a breakthrough in the democratization of this tech. It enables more people, especially at the youth and grassroot levels, to access performance coaching and talent scouting only recently available to the pros. Once again, this is a trend underpinned and accelerated by 5G.

7. Connected Fitness & Health

With people forced to quarantine in their homes due to the COVID-19 pandemic, the connected health and fitness sector saw a massive acceleration in 2020. But it’s just getting started and 2021 will see further growth, especially from recovery focussed solutions (including sleep tracking/management). For example, following health-tracking band WHOOP’s recent $1.2b valuation, look for performance recovery focussed Hyperice to join them in the sports tech unicorn club in early 2021.

As this market grows the emphasis is on platforms and technologies which can go beyond merely tracking user data to solutions that provide recommendations based on that information. The use of AI is crucial in ensuring these are pertinent and constantly improving as the volume and variety of user data inputs grow.

8. Frictionless Fan Experience — Stadiums & Venues

Although we don’t have an estimate on when exactly stadiums will be back at full capacity, expect the next time you’re watching a game in person to be a very different and for at least a few elements beyond the crowd atmosphere, hopefully, a much more streamlined experience than pre-pandemic. Cashless and touchless tech solutions will create a much smoother experience at concession and merchandise stands. In some cases this will be combined with biometric security features, including facial recognition, to rapidly speed up the ingress/egress process without compromising fan safety. There are obviously still major privacy concerns over the use of this tech but just as 9/11 shifted public sentiment and expectations for crowd security, expect the pandemic to do the same as fans return to crowded stadiums.

As teams, venues and their ticketing partners get more serious about data collection and analysis this opens up for a much more personalised experience to you as the individual fan (as with the broadcast experience mentioned above). Knowing more about who is in their venue and what their interests are can drive further revenue through delivering well-timed discounts and offers on F&B, merchandise and ticketing via the team or venue mobile app.

9. Athlete Empowerment

Athletes are taking a much stronger role in driving technology adoption and development in sports. They are no longer merely end-users of performance tech, but a new generation of entrepreneurs, tech investors and industry power players. Athletes are taking an active interest, and sometimes investment, in the tech they use (eg Kevin Durant/WHOOP, DeAndre Hopkins/Therabody; Patrick Mahomes/Hyperice; Stephen Curry/Tonal). This athlete buy-in and knowledge can only help advance the industry.

Also in this realm is the effect of rule changes allowing student athletes to monetize their NIL (Name-Image-Likeness). Look for the growth of technology focussed solutions which help teams, brands and student athletes maximise the upside of these changes.

10. Gaming & Esports

Gaming and esports shows no signs of slowing its rapid growth. Popular FPS gaming title Call of Duty brought in $3 billion in 2020, mainly through player microtransactions for skins and other in-game collectibles.

2020 also opened the door to what is possible for in-game live experiences, with over 12.3 million concurrent Fortnite players participating live in Travis Scott’s “Astronomical” virtual performance, an all-time record for the game. Expect to see more of this in 2021 as these gaming platforms vie to elevate themselves beyond just a game and potentially the new “social networks”.

The pandemic forced the first major pivot of real-life sporting events to a virtual setting . A notable example was the Virtual Formula One series which achieved a record-breaking 30 million views across TV and digital platforms during the initial lockdown period. You can learn more about Formula 1’s approach in the Sports Tech Feed podcast interview with Dr. Julian Tan (Head of Digital Business Initiatives & Esports). It will be interesting to see if these vitual “cross-over” events continue once the real thing can return with somewhat normalcy, but what remains certain is that traditional sporting leagues need to have a clear strategy when it comes to integrating esports and gaming.

Resources to help you stay up to date on the latest in the world of sports tech in 2021

Sports Tech Feed Podcast: In-depth interviews with industry leaders discussing the revolutionary impact technology is having on how sports are played, administered and consumed around the world. Apple Podcasts & Spotify

Sports Tech World Series Newsletter: Trending news, latest podcast episodes and industry deep dives delivered to your inbox every Friday. Your quick and easy way to stay updated on what’s happening in the world of sports tech.Subscribe.

LinkedIn: Daily shares articles, industry news & commentary. Connect.

__

Thomas Alomes is the Head of Americas for Sports Tech World Series, the world’s largest community for Sports Technology professionals, as well as host of the Sports Tech Feed Podcast.